The Pension Protection Fund’s annual Purple Book is almost universally regarded as the authoritative “state of the nation” guide to the UK’s private sector defined benefit schemes — their assets, liabilities, sizes, number and asset allocations. And given that this class of fund commands close to one and a half trillion pounds of assets, their actions are of wide interest.

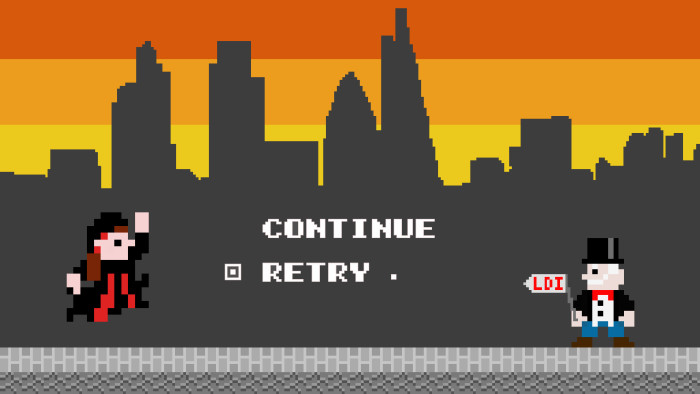

The headline from last year’s almanac was that these DB schemes — in aggregate — could afford to ‘buy-out’. That is to say they could afford to hand the keys of their pension funds to insurers, and walk away from the liabilities. Louis even made one of my all-time favourite Alphaville header images in honour of this event.

The headline this year, as covered by MainFT, is that last year’s headline was nonsense. The new Purple Book contains, along with fresh 2024 data, some absolute monster revisions to the 2023 data that we’d thought was locked in. Most eye-catchingly, the £150bn buy-out surplus has been revised away to become a £130bn buy-out deficit.

Admittedly, a ‘buy-out’ pension liability valuation is the most brutal of liability valuation measures. This brutality emanates from it using the lowest discount rate of any liability valuation measure and widest possible set of pension benefits. (Discount rates and liability valuations are inversely linked, just like bond yields and prices.)

While less eye-catching, what the PPF really cares about are ‘s179 liability’ valuations. Broadly speaking, an s179 liability is what the PPF is on the hook for if a scheme’s sponsor goes bust and the scheme lacks the assets to pay benefits. Using this measure, schemes are still sitting on a big surplus. Nonetheless, the Purple Book restates this measure of 2023 surpluses down by a cool £152bn — still a colossal number.

To understand what’s going on, we need to step back.

The PPF pulls together the Purple Book data using annual scheme returns, which defined benefit pension schemes are required by law to submit to The Pensions Regulator.

If you think that this return might contain a valuation of assets and liabilities, you’d be wrong. Instead, the annual return contains only a copy of the scheme’s latest s179 actuarial valuation. But s179 valuations are calculated only once every three years, and schemes then have 15 months to submit it following the valuation date. So the PPF’s data can be very very old. In fact, only 4 per cent of schemes submitted an annual return last year with an s179 valuation that related to the previous year.

Lacking current data, the PPF makes a guess as to what numbers schemes might report if they had all submitted an s179 valuation dated March of the current year — rather than whatever it was they actually reported. With so much guesswork going on, maybe the revisions are less surprising?

Let’s go through the figures to see how the PPF’s estimate of 2023’s s179 surplus (aka net funding) dropped by £152 billion:

First up are cash flows. Pension schemes have paid out more in pensions than previously assumed. It turns out that the PPF didn’t bother to model the fact that pensions pay, er, pensions.

We spoke to Shalin Bhagwan, chief actuary at the PPF, to understand why. He told us that the “Purple Book was originally intended to provide the PPF with a snapshot of the risk that it was running”. While paying pensions shrinks both assets and liabilities, it doesn’t really change the PPF risk position. And it’s true that including it hardly touches the total surplus estimate. So resources weren’t put into modelling these cash flows until now.

Next up is “PPF drift” / actual inflation. This is a bigger deal.

Until last year, the PPF took s179 liability valuations submitted by schemes to The Pensions Regulator and totted them up. Actually, they didn’t just tot them up, they also ‘rolled forward’ their present values using more-up-to-date bond yields so they’re all on close-to-the-same-page in terms of their basis of valuation. Seems sensible.

But defined benefit pensions tend to be inflation-linked. And the PPF only made allowance for liabilities’ inflation-linkage up to 2.5 per cent per annum — in line with their compensation terms for schemes that have been picked up by the pensions lifeboat. Remember when inflation spiked to 11.1 per cent in October 2022? Eek. With such a high share of valuations posted before inflation spiked, the old figure was on the low side. Indexing to actual inflation rather than PPF-compensation inflation lifted the estimate by £60bn.

Lastly, we come to “refined asset roll-forward, including a wider set of market indices”. Is this a euphemism for “My investment manager turned out not to be the genius I thought s/he was”? No.

With schemes providing only lagged data, the PPF needs to do a fair amount of guesswork to arrive at a total asset number. But hey, DB schemes are stuffed full of bonds these days, so how hard can it be? Harder than we’d have predicted.

As FTAV readers will know, not all bonds are the same. A one-year bond’s price hardly moves if yields rise or fall by 100 basis points, while a fifty-year bond’s price jumps around by maybe twenty five percentage points on the same yield shift. And it’s only really post-LDImageddon that the Regulator has asked schemes to provide asset allocation data on their annual returns that would allow the PPF to split bonds into half-sensible maturity buckets. Armed with this new data, the PPF found that schemes went into the bond meltdown with their liabilities much better-hedged than previously assumed. In other words, while the PPF knew pension funds had lots of bonds, they hadn’t understood that quite so many of these bonds were the really long-dated ones that totally puked. Armed with this new information, the PPF cut their asset estimate by £89bn.

If you’ve got this far and are wondering “So what?”, you’re likely not alone. Let’s switch to bullet point format to speed things along and flag some potential winners and losers.

Losers

Bulk annuity insurance firms:

-

OK, so the number and value of individual viable prospective clients has not actually changed an iota. After all, this is a story about how models didn’t capture reality. But a common metric of their total addressable market has just shrunk quite a lot. In 2023 the PPF estimated that 3,163 schemes could afford to be buy-out customers. Now, it reckons only 1,852 could afford the price of buy-out. 😞

-

Still, insurers continue to print vast volumes of transfers, so let’s not feel too sorry for them.

Policymakers:

-

We can’t be sure, but the decision to focus first on Local Government Pension Schemes and Defined Contribution pensions in the Pensions Review may have been informed at the margin by an understanding that large, closed DB pensions were a spent force, most likely to be consolidated by insurers. Given that they are now no longer good for buy-out, maybe they should’ve been higher up the policy to-do list? 🫣

-

Furthermore, back in February the government consulted on the plan to have the PPF use its excess reserves as capital for a new public sector superfund consolidator for over-funded small schemes. Their newly understood (weaker) funding position could make the whole enterprise a more distant prospect.

Trust in pensions data:

Winners

UK asset managers and Superfunds:

Pension fund trustee egos:

-

You’re an average trustee trying to do your best for your scheme. Your funding has improved from around 75 per cent to around 90 per cent on a buy-out basis between 2022 and 2023. 😊

-

But the 2023 Purple Book told you that all your peers had reached 110% buy-out funding, having better-dodged LDI asset writedowns. This made you sad. 😔

-

You now learn that everyone else is actually in the same boat. 😌

The truth:

-

Official data gets restated and revised everyday. In all likelihood the new data will get revised again as new and better information comes to light. When you find a data problem, the best thing to do is always to stick up your hand and fix it. 😇

Publishing an authoritative Bumper Book of UK Pensions was never the PPF’s brief. But this hasn’t stopped gilt market / asset management / policy types, or indeed us from treating it as such. Ultimately, it’s a good thing that the PPF has stepped up its efforts at providing a more accurate guess as to where system-wide assets and liabilities might be. Even if doing so is a bit embarrassing.