On the western border of Florida’s Ocala national forest, an hour’s drive north of Orlando, there is a half-acre plot that may soon be the subject of international litigation. Not for its contents — the site still sits undeveloped and has been reclaimed by woodland — but over its owner.

Records at Marion County’s property appraiser show the tract was bought two decades ago by Saifuzzaman Chowdhury, the former land minister of Bangladesh.

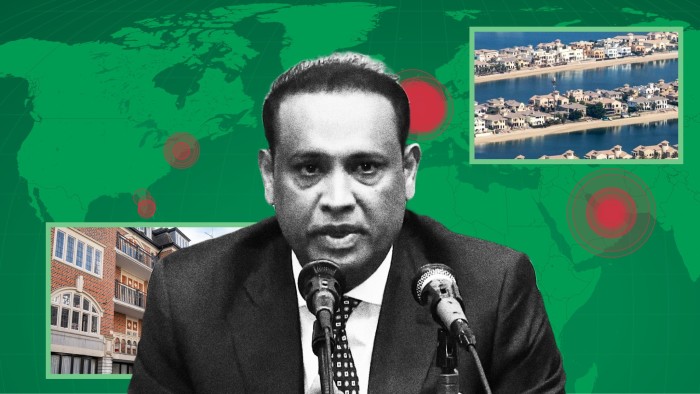

The $48,000 purchase was one of Chowdhury’s first pieces in an extraordinary real estate empire built up, for the most part, while he served as an MP in the government of Sheikh Hasina. The FT has identified 482 properties acquired by Chowdhury or his close family at a cost of at least $295mn between 1992 and 2024.

Now Bangladesh wants some of that money back. Chowdhury is one of the key targets of attempts by Bangladesh’s interim government to claw back funds from people who, it says, stole billions of dollars from the country during the 15-year rule of Sheikh Hasina. The authoritarian former prime minister was toppled last year by a student-led uprising and driven into exile in India.

The holdings of Chowdhury range from Dubai’s glitzy Burj Khalifa district and its Palm Jumeirah artificial archipelago to buy-to-let flats in London’s commuter towns, including a two-bedroom unit in a new-build development close to Slough train station.

Before becoming Sheikh Hasina’s land minister, Chowdhury was one of her MPs for over five years. In 2023, he declared to parliament that he had assets equivalent to $2.3mn. His last declared income tax return, covering 2017, states he had no foreign income at all.

Along with others of the country’s elites under Sheikh Hasina’s regime, he and some of his relatives stand accused of embezzling money from a Bangladeshi bank.

Ahsan Mansur, the central bank governor tasked by the interim government with recovering stolen assets, estimates that individuals linked to Sheikh Hasina’s Awami League party siphoned at least $16bn out of Bangladesh’s banking system.

Muhammad Yunus, the Nobel laureate who leads Bangladesh’s interim government, tells the FT: “This is people’s money that in broad daylight they have taken away because they had the state machinery in their hands.”

Chowdhury is one of the main tycoons linked to the old order who is in the interim government’s sights. Mansur says of him: “He was the land minister, and it seems he loves land.”

An FT analysis of leaked and official sources suggest that Chowdhury and his close family have owned — and largely continue to own — a much greater number of properties than previously reported: 315 properties in the UK; 142 in Dubai; 16 in New York; six in Florida and three in New Jersey.

The FT has also identified $578mn of properties acquired by other Bangladeshi elites in the sights of the interim government, in places as far afield as Singapore and Canada.

Yunus has described the alleged looting of banks by elites as “highway robbery”, and said the money “has to be brought back”.

As Bangladesh rebuilds after Sheikh Hasina’s reign, its authorities have turned to reclaiming the money they say was lost to corruption by her allies and officials — funds they say are needed for the country’s developing economy.

The effort will be a demanding test for the country’s under-resourced justice system and bureaucracy, which is still packed with Sheikh Hasina loyalists who the Yunus camp acknowledge could hinder the effort.

Governments that have taken power after allegedly kleptocratic regimes, from the post-Marcos Philippines to Ukraine after Viktor Yanukovych, have often tried to recover money. But those efforts have foundered for legal or other reasons, and produced modest and at best partial results.

As Bangladesh begins these efforts, the US Treasury has been providing technical assistance. Its first steps will be to bring domestic legal cases against the alleged perpetrators and preparing formal international legal assistance requests to the US, UK and elsewhere that would pave the way for potential future international cases.

“If we feel that the world is a community of friends living together, if my money is stolen and deposited in your country”, Yunus says, “I think there’s an obligation to help us to bring it back.”

The scale of Chowdhury’s property empire in the UK, along with revelations that former minister Tulip Siddiq was given a London property linked to her aunt Sheikh Hasina’s allies, also raises questions about the strength of regulations aimed at preventing economic crime and illicit finance, and the British government’s ability to crack down on dirty money.

The UK’s International Anti-Corruption Coordination Centre, hosted by the National Crime Agency, says it is “exploring opportunities to assist the interim government of Bangladesh and its law enforcement agencies in their efforts to investigate allegations of grand corruption within the former government.”

Chowdhury did not respond to multiple requests for comment. His brother Anisuzzaman Chowdhury, who is also listed as the owner of a smaller number of properties, said in an email that his own business interests were separate and that he made his purchases with mortgages “done through proper due diligence” as well as an inheritance from their father. His family was being targeted, he added, because they were “part of [the] previous regime”.

The story of the Chowdhury family mirrors those of others seen as close to the old regime who built fortunes when the Awami League ruled the country.

Alliances between Sheikh Hasina’s party and business families helped to entrench her party’s rule, the new government says, and back an increasingly repressive state during her 15 years in power.

Chowdhury’s father, Akhtaruzzaman Chowdhury, was an Awami League politician and close confidant of Sheikh Hasina, and belonged to the founding board of directors of United Commercial Bank, established in 1983.

He became notorious for two violent incidents involving the UCB, events that the interim government sees as precedent for the forcible takeover of other banks in the final years of Sheikh Hasina’s rule.

The first was the fatal shooting of UCB’s founding chairman Humayun Zahir outside his home in Dhaka on April 8, 1993, amid a dispute among the bank’s directors. Akhtaruzzaman was arrested in connection with the murder, but later fled the country after being released on bail.

When the Awami League took power in 1996 and Sheikh Hasina first became prime minister, Akhtaruzzaman returned to Dhaka. He remained on bail, but legal proceedings against him eventually faltered.

The second act of aggression came in 1999, when Akhtaruzzaman attempted to seize UCB at gunpoint, forcing the board to resign.

A court later reinstated the ousted chair and Sheikh Hasina lost power two years later. But after she returned as prime minister in 2009, Akhtaruzzaman once again joined the board of directors.

He died in 2012, but under Saifuzzaman the family was able to tighten its grip on UCB. Its board was dominated by his influence until last year, when the central bank overhauled it in the wake of Sheikh Hasina’s fall.

During Hasina’s authoritarian rule, business elites funnelled resources into the Awami League, giving it the wherewithal to suppress the opposition and leaving the strongwoman virtually unchallenged until last summer’s street protests swept her from power.

“Political leaders used the state’s security apparatus to facilitate a hostile takeover of large commercial banks by their cronies, who in turn used their new ownership stake to siphon off billions of dollars through ‘loans’ that would never be repaid — and later compensated those politicians with gifts of real estate abroad,” says Mushfiq Mobarak, a professor of economics at Yale University who researches Bangladesh and has worked for the World Bank and IMF.

Since Sheikh Hasina fled to India in August, Yunus’s interim government has begun drawing up reforms of institutions it claims were captured wholesale by the Awami League, including the police and judiciary.

A report on the state of Bangladesh’s economy commissioned by Yunus said in December that the country lost $16bn annually to money laundering under Sheikh Hasina’s rule from 2009 to 2024.

The report analysed spending on large public projects, tax exemptions and the management of banks, which the authors identified as “corruption-ravaged” by “heavyweight” culprits.

Anisuzzaman Chowdhury said his family always held a majority stake in UCB and so did “not need to seize the bank”, adding: “There [is] no evidence [of] us taking any private gain, while on the board of the bank, all loans were approved by the law of the country and central bank.”

Investigators hoping to retrieve some of these funds will need to grapple with the scale of the property empires that have been built, their geographical complexity and apparent attempts to obfuscate what properties alleged perpetrators bought.

In Saifuzzaman Chowdhury’s case, the properties identified by the FT are clearly linked to him, with his name appearing directly on the paperwork. But many of the units have been acquired with mortgages, in what one of his agents said was an apparent attempt to allay concerns.

Chowdhury’s estate agent, Ripon Mahmood, was recorded last year speaking to undercover Al Jazeera journalists, telling them that his client avoided buying in cash outright because “big money, big numbers [makes] everybody get alert”, adding that his client uses mortgages so that he might then say: “Look, I didn’t buy cash. Bank lent me money.”

One loan agency appears to have been critical to Chowdhury’s sudden surge in house-buying, which took off after he was appointed land minister in 2019.

The bulk of the British mortgages came via entities linked to a lender named Market Financial Solutions, owned by the British businessman Paresh Raja, according to Companies House filings.

These entities first started giving Chowdhury-linked companies loans in mid-2019, and are listed as being involved in 291 of the 495 charges registered by the companies.

After the fall of Sheikh Hasina’s regime, many of the loans were repaid. In August and September 2024, companies linked to Chowdhury and his family suddenly satisfied 259 of their 352 mortgages, including all the outstanding MFS-linked mortgages identified by the FT as connected to the businesses.

It is possible that some of the properties have been passed on. Records seen by the FT suggest that some of the properties in Dubai have since been sold. And in January, the largest remaining lender to Chowdhury’s UK businesses identified in filings, Singapore’s DBS Bank, filed paperwork to repossess 12 of his properties.

A spokesperson for DBS said: “Months before any external enquiries — in early 2024 — DBS controls had proactively flagged some issues, following which an appropriate review was initiated and concluded.”

The FT asked Raja and DBS how Chowdhury could have passed anti-money laundering checks in the UK given his status as a politically exposed person from a high-risk jurisdiction who had published financial statements suggesting he had assets only amounting to $2.3mn.

DBS declined to “comment further on any specific accounts or individuals”.

Raja’s lawyers say Market Financial Solutions has “a large underwriting team who scrutinise every loan and carry out detailed and thorough AML and other checks”, adding that Raja “has no connection to Bangladesh or the Hasina government”. They added that Mahmood, the estate agent, had apologised to their client for “making false claims about them during covert filming, and has withdrawn the claims”.

Lawyers for Mahmood said that his first language was not English, which meant that “how Mr Mahmood expresses himself is at risk of being open to interpretation and misconstruction”. They also said he conducted all due diligence checks required of an estate agent.

Transparency International’s Ben Cowdock, who has investigated properties in the UK owned by Bangladeshi elites, says that “understanding a potential client’s source of wealth is a vital part in the private sector’s role as a first of defence against money laundering”, adding: “Businesses failing to carry out adequate checks on clients or report suspicious activity to the authorities are welcoming dirty money on to our shores.”

The broader push to reclaim assets will require forensic audits of the looted banks and tracing of complex transactions, say Bangladeshi and foreign officials.

Money may have passed through multiple hands, including employees such as drivers, on its way out of Bangladesh — often in the form of cash.

Dhaka has engaged Deloitte, EY and KPMG to perform an asset quality review of the country’s banks and set up 10 joint investigative teams to trace the assets of 10 leading families, as well as Sheikh Hasina’s.

Although the interim government has not publicly confirmed which specific families Bangladesh’s task forces were targeting, a senior official says they include the families of Bashundhara Group chairman Ahmed Akbar Sobhan and S Alam Group chairman Saiful Alam. Both have been accused by Dhaka of profiting from allegedly irregular bank loans.

Company records show Alam’s permanent residence is a $21.9mn mansion in Singapore, where he has acquired commercial real estate, including hotels, worth an estimated $469mn.

Lawyers for Alam and his immediate family said that these accusations are “denied in their entirety”, adding the businessman’s “interests have been audited by the Bangladeshi authorities for many years, with no findings of impropriety” and that they are “prepared to commence international legal proceedings to defend their investments”.

Sobhan did not respond to a request for comment. The FT has identified 26 properties in the UK on which Sobhan’s family members spent at least $65mn.

Bangladesh’s Anti-Corruption Commission is investigating allegations of unexplained wealth, including overseas assets, against Sobhan and a number of his family members.

For Bangladesh’s authorities, the issue is not limited to the country’s elite families. Other figures from the Awami League and the country’s powerful garment-export industry have acquired property overseas.

Toronto, for example, is so popular among wealthy Bangladeshis that it has become a prime example of Begum Para, an expression meaning “colony of wives” but which has come to refer to people whose family members reside in comfort in affluent areas overseas.

A $1mn house owned by the wife of a former Awami MP is one of 12 properties, worth around $13mn, identified in an FT search of Ontario land registry filings.

While Yunus tells the FT there is “significant money” in Canada, his administration believes that Bangladeshi elites have stashed away their assets where they might be hardest to recover — in Dubai.

Saifuzzaman Chowdhury appears to have amassed a diversified rental portfolio in the UAE, which was until a year ago under increased monitoring by the Financial Action Task Force, a global watchdog for financial crime.

Chowdhury’s properties are concentrated in Dubai and range across different price brackets. The FT analysed them using a database of property ownership records gathered by the Center for Advanced Defense Studies (C4ADS), a Washington think-tank.

It shows 98 complete property records from 2022, with estimated valuations of $28mn. There are, however, a further 39 addresses with incomplete data. His brother Anisuzzaman is listed as having been the owner of five more.

The C4ADS Dubai Property Database shows a central role for Anthony Joseph Abou-Jaoude, a broker who says he dealt with a portion of Chowdhury’s property portfolio for several years. “He introduced himself in Dubai as land minister and chair of UCB bank,” Abou-Jaoude says. “And all developers welcomed him.”

But Abou-Jaoude says that the brokerage he worked with stopped dealing with Chowdhury following media reports about the former land minister’s wealth last year.

The letting business is likely to have generated solid returns as the city’s rental rates climbed over 20 per cent for two years running, according to consultancy Mercer, which tracks costs of living in metropolitan areas worldwide.

Chowdhury bought almost an entire building at the Polo Residences, a copy-paste development of low-rise units, their balconies featuring drying laundry and pot plants, in a quiet area not far from Dubai’s racetrack.

He acquired the apartments in this building — Polo Residence A2 — while an MP in Bangladesh, but listed his residence as American Samoa on their property records.

An Airbnb listing for one of the 31 apartments he bought at Polo Residence A2 shows a framed piece above a kitchen sink that reads: “It’s so good to be home.”

Additional reporting by Redwan Ahmed and Ilya Gridneff

Cartography by Steven Bernard