Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chinese technology giant Tencent is taking a €1.2bn stake in a new spin-off from Ubisoft, as the struggling French games developer attempts to shore up its balance sheet.

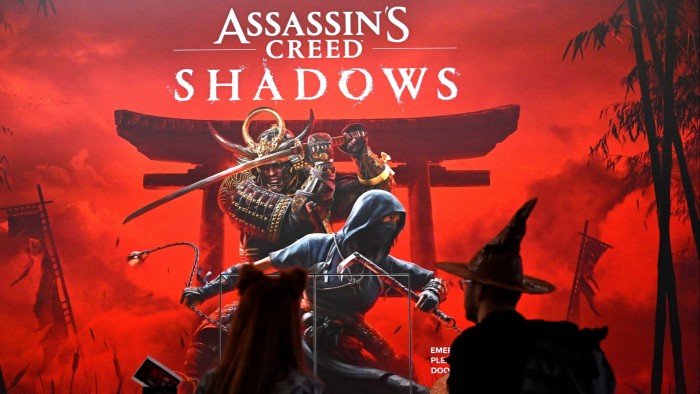

The deal values a new subsidiary that will run Ubisoft’s top franchises — including Assassin’s Creed, Far Cry and Tom Clancy’s Rainbow Six — at about €4bn.

Shenzhen-based Tencent, one of the world’s largest video games companies by sales, will own about a quarter of the new unit, with Ubisoft controlling the remainder.

Yves Guillemot, Ubisoft’s co-founder and chief executive, said the deal marked a “new chapter” for the Paris-based company as it strives to create “evergreen, growing” games.

Ubisoft’s shares have fallen over 33 per cent in the past year to a market capitalisation of €1.7bn, despite receiving a bump last week following the much-anticipated launch of the latest instalment in its Assassin’s Creed franchise, which had previously been delayed.

Revenues for the nine months ending in December fell by almost a third, as it attempted to slash hundreds of millions of euros in costs.

Tencent already owns about 10 per cent of Ubisoft, with the Guillemot family owning 15 per cent. The Chinese group also purchased just under half of the Guillemot family’s holding company in 2022 when the founders needed to refinance their debt.

“As we accelerate the company’s transformation, this is a foundational step in changing Ubisoft’s operating model that will enable us to be both agile and ambitious,” Guillemot said.

“With the creation of a dedicated subsidiary that will spearhead development for three of our largest franchises and the onboarding of Tencent as a minority investor, we are crystallising our assets, strengthening our balance sheet, and creating the best conditions for these franchises’ long-term growth and success.”

Tencent has signalled before that it would like more control over Ubisoft’s operations. Its president Martin Lau said: “We see the immense potential for these franchises to evolve into long-term evergreen game platforms and create engaging new experiences for gamers”.

Paris-listed Ubisoft’s performance has suffered over several years because of launch delays and falling revenues. Allegations of sexual harassment by former top executives within the group, whose trial opened in France earlier in March, have also hit the company.

The company cut its outlook for the year in September, saying that net bookings for the 2024-2025 fiscal year would be around €1.9bn, lower than the year before.

Ubisoft and its bankers had sought to drum up interest from private equity bidders in its new entity as it looks to bring new investment into the business. However buyout groups were hesitant about investing, particularly given the structure of the deal, according to several people familiar with the matter.

One person familiar with the situation said that Tencent was keen to reinforce its influence over Ubisoft by investing in the new spin-off, which contains its most valuable intellectual property.

However any attempt to wrest control of the entire company would probably meet with opposition from the French state, a second person noted.

Ubisoft itself will now focus on its other franchises, including Tom Clancy’s Ghost Recon, The Division and Just Dance, as well as developing new titles. The company said it would provide more detail on its future operating model “at a later stage”.

The companies hope to close the deal by the end of this year. Ubisoft will grant an exclusive, irrevocable, perpetual license to its top three games to the new subsidiary, in return for a royalty. The games’ developers will also move to the new unit. Ubisoft will use the proceeds from Tencent’s investment to pay down debt.