Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

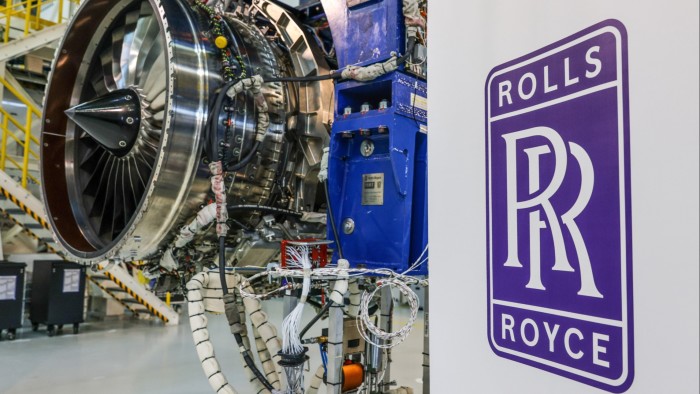

Rolls-Royce said it would hit its profit targets two years early and launched a £1bn share buyback as the UK aerospace company benefited from strong demand for its jet engines, sending its shares up 15 per cent on Thursday.

The FTSE 100 company, whose engines power some of the world’s largest commercial aircraft, said it would achieve its “mid term” profit targets, set in 2023, two years earlier than planned, in the latest stage of a turnaround under chief executive Tufan Erginbilgiç.

Before Thursday’s rise, shares in the company had already climbed by more than five times over the past two years, as investors bought into the restructuring that Erginbilgiç launched after becoming chief in January 2023.

Rolls-Royce on Thursday issued new mid-term targets, including a goal to deliver underlying operating profit of £3.6bn and £3.9bn by 2028 along with an operating margin of between 15 and 17 per cent.

Erginbilgiç said the new targets were a “milestone not a destination” and said the company saw “strong growth prospects beyond the mid-term”.

Rolls-Royce announced a dividend of 6 pence per share for 2024 and said it would launch a £1bn share buyback.

The buoyant outlook came as Rolls-Royce reported strong demand for its jet engines, in spite of supply-chain concerns which have dogged the civil aviation sector since the end of the pandemic.

Rolls said this reflected “continued strong demand for travel” as the aviation industry boomed in 2024.