The Paris School of Economics sits on the drab grounds of what was once the École Normale Superieure for girls, tucked away on the city’s unspectacular bottom edge. The PSE was only founded in 2006. It only teaches graduate students. It can’t match Harvard’s $53bn endowment. Yet it’s a remarkably influential place.

The school’s president, Esther Duflo, is a Nobel laureate in economics recently returned to her hometown from Harvard. The PSE’s co-founder, Thomas Piketty, did more than anyone else to put inequality on his profession’s agenda. Two decades ago, he also supervised the masters thesis of the school’s current star, Gabriel Zucman, on whether high taxes prompt rich people to emigrate. Today Zucman, a boyish-looking 38, winner of the John Bates Clark Medal for young economists that often precedes a Nobel, is leading a drive to impose a global wealth tax on the super-rich.

The EU Tax Observatory, which Zucman runs, hosted a conference in April at the PSE for the small but global community that has clustered around this tax. Besides economists, there were delegates from the IMF, the Brazilian government, Belgium’s workers’ party and an OECD official attending in her private capacity as a “tax nerd”. PSE’s more profit-maximising students snuck in for free helpings of the Parisian-quality lunch buffet. The message of the conference: the super-rich pay lower tax rates than ordinary people, but Zucman and his followers intend to change that.

Though the speakers at the conference were almost all men, their field was arguably pioneered by a woman. In 1941 Helen Tarasov, an official in the US Department of Commerce, co-wrote a monograph called Who Pays the Taxes?

It took nearly another 80 years to estimate what rates the super-rich actually paid. “Billionaires are very visible, except in most public statistics,” Lucas Chancel of Parisian university Sciences Po told the conference. Their income tax returns are often modest, because their wealth usually stems not from labour but from their stakes in companies.

The super-rich rarely pay much tax on these stakes. Most of these people are liquid enough to leave profits in their companies, rather than taking money out in taxable dividends. (Amazon, for instance, has never paid a cash dividend, while Alphabet issued its first ever only last year.) So rich people’s piles of money grow, untaxed and often hidden from sight in holding companies.

How to map the wealth of the super-rich? From 2018, Piketty, Zucman and their collaborator Emmanuel Saez led a global effort to measure all national income. That required combining many different data sets: shareholders’ registers, income tax and corporate tax returns, data on companies’ foreign activities and even “rich lists” compiled by Forbes and others. Piketty and co set up the World Inequality Database (WID), to which more than 200 economists contributed data. Their findings suggested the super-rich were richer and more numerous than previously thought. Inequality peaked in South Africa, where the WID estimated that the richest 1 per cent owned 55 per cent of national wealth.

The conference started with presentations on countries as diverse as Brazil, the Netherlands and the US, but the findings were strikingly similar: each nation’s super-rich are undertaxed compared with ordinary people. Zucman’s presentation on the US was typical: between 2018 and 2020, the country’s effective average tax rate was 30.7 per cent, but the 100 richest Americans paid a little over 20 per cent. The tax cuts they got from Donald Trump in 2018 helped, but the problem is much older. In 2012 Warren Buffett complained that his secretary “works just as hard as I do and she pays twice the rate I pay”. No wonder the wealth of the 400 richest Americans has climbed to equal 20 per cent of US GDP, up from 2 per cent in 1982.

The rich dodge taxes even in death. “The estate tax has almost disappeared in the US,” said Zucman. The effective rate paid by single descendants (typically the last surviving spouse of a couple) is 7 per cent, compared with a statutory rate of 40 per cent. Similar dynamics suppress British inheritance taxes, says Arun Advani of Warwick University.

Or take Brazil, whose extreme inequality is only exacerbated by its tax system. Nearly half of Brazilian tax revenue comes from consumption taxes, says Theo Palomo of the PSE. These disproportionately hit the poor, who consume most of their income. But Brazil doesn’t tax dividends, which mostly go to rich people. Palomo calculates that whereas ordinary Brazilians pay effective tax rates of 45-50 per cent, the top 1 per cent pay about 20 percentage points less. Zucman said he couldn’t find any example of a country that’s been successful in taxing the super-rich.

One attendee started a question: “It sounds like from all these presentations, we should tax billionaires . . . ” before being interrupted by general laughter. Yes — that’s the message. And it could soon start becoming policy.

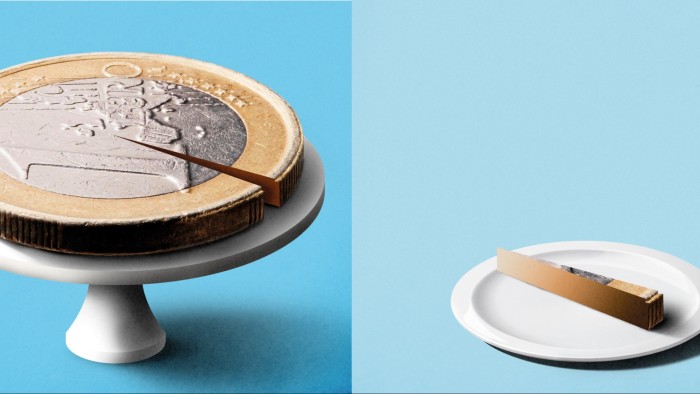

Zucman’s project is that every billionaire should pay total annual taxes equalling at least 2 per cent of their wealth. That, he explained, is the level where they would pay the same tax rate as everyone else. If someone already pays 2 per cent through income and other taxes in their own country, “you are good, there’s nothing more to pay”. If they pay less, then any country where they do business could levy additional taxes to reach 2 per cent. For instance, Brazil or France could tax Amazon’s founder Jeff Bezos, as his company operates there.

“It’s a bold proposal, yet modest at the same time,” said Zucman. He explained that his “starting point” was learning from the “failure” of most previous European wealth taxes. Whereas they hit millionaires, his would exempt even those with wealth of €4.8mn (the threshold for entering the global 0.1 per cent).

This is hardly the Bolshevik revolution. Indeed, 2 per cent wouldn’t even reduce inequality, as billionaires’ wealth has been growing by 7 per cent a year. Piketty, who supports his former protégé’s plan, grumbles that it’s only “a useful first step”.

The EU has long backed Zucman’s research. But his big breakthrough came last year, when Brazil, host of the G20 summit, invited him to present his plan to the assembled finance ministers. Brazil twisted the arms of even Argentina’s libertarian president Javier Milei to agree to a shared declaration: “With full respect to tax sovereignty, we will seek to engage cooperatively to ensure that ultra-high-net-worth individuals are effectively taxed.”

That created modest global momentum. Brazil took the declaration to the UN Tax Committee and rich-country club the OECD. At home, Brazil’s government seeks a minimum tax on the 141,000 Brazilians with average incomes of more than R$1mn ($172,000). It also wants to institute a dividend tax. In France, the Assemblée Nationale voted in February for a minimum 2 per cent tax on the wealth of people with net worth above €100mn. France’s upper house of parliament, the Senate, probably won’t pass the “taxe Zucman”, but the state wants to implement a milder minimum tax of 0.5 per cent on net wealth. The UK has scrapped the “non-dom” scheme that allowed people not to pay taxes on foreign income and gains, and Zucman is selling his plan to officials from other European countries.

He’s optimistic. Surveys show broad public support for the 2 per cent tax. He says few political parties dare oppose it as that would mean they back “the right of billionaires to pay zero tax”. And even if a minimum tax starts low, once in place, it can be raised.

He says a global tax can work even if countries including Trump’s US shun it. Rich people can be taxed wherever they do business. Those moving to tax havens could be charged an exit tax. If long-term residents of France move, say, to lower-tax Switzerland, Zucman wants France to continue taxing them for years. Sceptics will remain unconvinced.

One possible outcome is that more countries will raise other taxes on the rich, without introducing wealth taxes. After all, notes Advani, states typically have trouble enough making existing taxes work without creating new ones. The starting points might be higher taxes on capital gains and inheritance. That would be in the spirit of Zucman’s movement.

Piketty, an attentive listener for much of the conference, took the stage at the end to bless the movement. He hoped for “a wave of reform”, like between 1910 and 1940 when developed countries adopted “very progressive” income taxes.

He scoffed: “You always have people who say, ‘The wealthy are too powerful, nothing will happen.’” Admittedly, that has been true for decades. But the Paris School of Economics is a formidable opponent.

Simon Kuper is an FT columnist